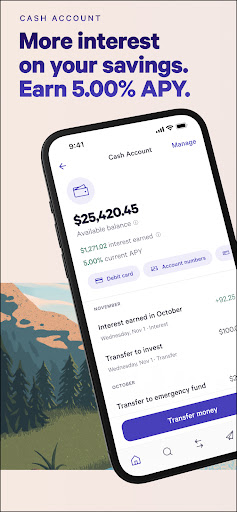

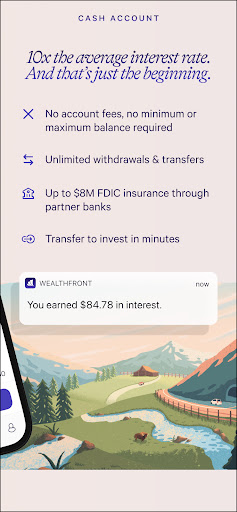

I don't write good reviews often, but this app and account is one of the better banking apps I have used. The UI and account management are highly transparent. The fees are low, the earned interest rate is high, and the flexibility of transferring funds internally and externally is very fairly executed. Only con is no third party external wire transfers, but that seems somewhat standard among starter hybrid banking-brokerage accounts.

I'm just starting to save, slowing. Wealthfront is great because there is no minimum transfer amount and you can do as many transfers as you want! Also, app is user-friendly and modern. I'm looking forward to when I have enough to start investing through the app.

An extremely user-friendly app for account management. The UI is easy to navigate around. It is simple to transfer money in and out of the cash accounts and the automated smart transfer to put them in different categories helps organized your budgeting and spending needs. The money transfer, though, could be a little quicker, as it takes a few days for me to see the transferred amount on my account. An enormous benefit is the high yield savings you can use to hold your emergency cash.

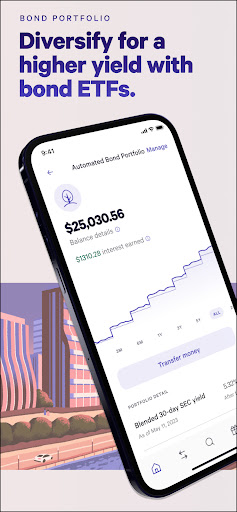

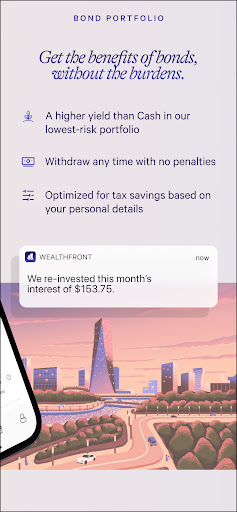

I really like this platform for it's ease of use, clean and attractive UI, very easy to transfer money in and out of cash accounts as well as investment accounts. New same day or one day. Cash transfers are really nice as well. I just wish the process for liquidating a stock position was faster. All in all, I still really like it and continue to use it as a really great option for a high yield cash account for cash savings. I use other platforms for primary investing but love this for savings!

Good returns on your cash with all the features of a regular checking acct. I haven't tried the auto investing, and the selection of ETFs isn't as expansive as is available in some other apps, but the ones they do have generally have low expense ratios and are good for us regular-guy savers and investors who just want a basket of decent funds and stocks to build on. Fractional, dollar-based investing is easy on the app.

Easy to setup an account and transfer money in for that high-interest savings, and also easy to setup multiple investment portfolios and invest some of that savings (only what I was prepared to lose though)! I love coming back after the close of markets every day to check on my portfolios and do some looking at individual investment values. Highly recommend this app!

Seems to be a pretty good opportunity and very nice app compared to some others. I do wish the graph could show your change net worth over time instead of just a future projection. This app has some nice features, for example it can help you make descisions for buying a house, taking into consideration your income and savings.

Since discovering wealthfront in 2020, I have been more than satisfied by my experience. I have not run into any bugs glitches or major issues. As the company matures more features that I wanted were added such as wire transfers etc. Can't think of better integrated banking app for short term and long term yields in a mostly liquid product.

So far it's been very straightforward in managing my account, setting up transfers, etc. The app will show you estimated times on when transactions will be available or ready to view and there's lots of other features I have yet to utilize. This app is simply well-made and does what you need for banking, nothing more and nothing less! User interface inside the app is not too complicated and the organization is very delightful for me as a new user. Definitely recommend!

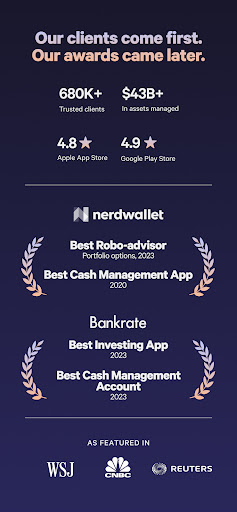

The user interface of the app is very intuitive, and they make setting up different accounts and connecting them to other bank accounts very simple and streamlined. I love how I can see how much I'll save in a few decades with their algorithm. Very well-designed and easy to use. However, the app does not update my mortgage and a certain bank account that I closed a while ago, so it'd be great to see that improvement. Overall, highly recommend if you're looking into robo-investing!

Great to see my accounts in one place. love the net worth calculator and predictions for future retirement/spending capabilities. only issue with the app is that it's not very easy/intuitive to renew links with external accounts. I wish I didn't have to renew as frequently, but I understand the security aspect of it. the app can do better in the renewing process. Right now it's unclear that you have to click renew and prompt the text and then exit and click renew again to enter the texted code.

*Updated* It was easy to add my accounts; including credit cards, mortgage and even my CalPERS plan. The downside is that the app can't calculate a defined benefit plan. You have to guesstimate your earnings and add as "other income." Aside from that, the app is laid out well and easy to use. Automated investing seems to work, though idk how they select stocks. Wish it had an option to manually invest. Also, adding funds should be instant with electronic transfer but takes 3-5 days.

Very intuitive GUI! Info is easily accessible to help you understand where your funds are going and how they impact your overall plan. Even if you don't invest with Wealthfront, the ability to track your finances in one simple location makes the app worth it. Unfortunately, linked account update times vary depending on service. My T. Row Price connection is especially finicky. The app still provides a great overview, but be sure to cross-reference your accounts for more accuracy.

I really enjoy the product and have been impressed by how many integrations they have up and running. It's been useful to track assets across a number of different accounts to get a unified picture. Only negatives: - Things occasionally go down, but are easily repaired. - I find myself checking the app just to check, which I don't think is useful or healthy - sometimes I wish there was something more actionable I could do.

I've downloaded a lot of different finance, banking, and investing apps. Most of them I always delete. This one, I'd never think of it! The ease of use and the intuitiveness is unmatched. Also, the products Wealthfront offers are great. One of the best if not the best online savings accounts. They're very transparent about the change in rates. Also, there's some great investing offers. I've yet to dive into those though. Overall, great app. Highly recommend.

Great concept, and no mishandling of my funds yet. However, the app has two bugs I have noticed so far. 1) Negative balances in loans are shown as positive on the balance screen and 2) Sometimes when linking external accounts, the process bounces back to the login screen without any notification. Then I have to return to the home screen to see a notification that the account needs extra verification. This bug makes adding accounts somewhat tedious.

Have been using Wealthfront for a few years now and have always loved their interface. However the most recent update makes the UI worse, I preferred the previous UI. You can no longer see your deposits vs account value at a glance. Trying to see the information on the graph at the very edge of the screen causes the app to go back (swipe back on android), and my finger isn't small enough to get to the edge from the middle. The TWR & MWR have become paragraphs instead of numbers at a glance too.

The only thing I use the mobile app for is depositing a few checks a year. In the current version, they've managed to introduce *multiple* bugs that make this very difficult. If my screen is locked to portrait mode, the app now shows the camera preview in portrait as well, which scales it down to be comically tiny. When I unlock my screen orientation, if my device ever rotates the screen at any point during the check deposit process, I have to start over from the beginning. I regret updating.

I gotta say, this app is pretty impressive. Now, I cannot say much about my experience with the investment service because I have just recently started using it. But definitely a good experience over the course of my first two weeks if you discount the mild frustration that came with getting my interest rate cut by .2 two days after I threw money into it... Oh well. Please introduce dark mode! It's basically mandatory at this point.

I was not able to setup my cash account using the App. It just keeps sending me back to linking page without an error. I had to complete it on the website. Also I could not setup two factor authentication in the app because if you need to copy the authenticator code to paste in your authenticator app, it signs you out immediately when you switch apps, meaning you cannot finish the setup. Joint cash accounts don't have checking features. So no direct deposits, debit card, etc. Only individual.